Why this matters and why now

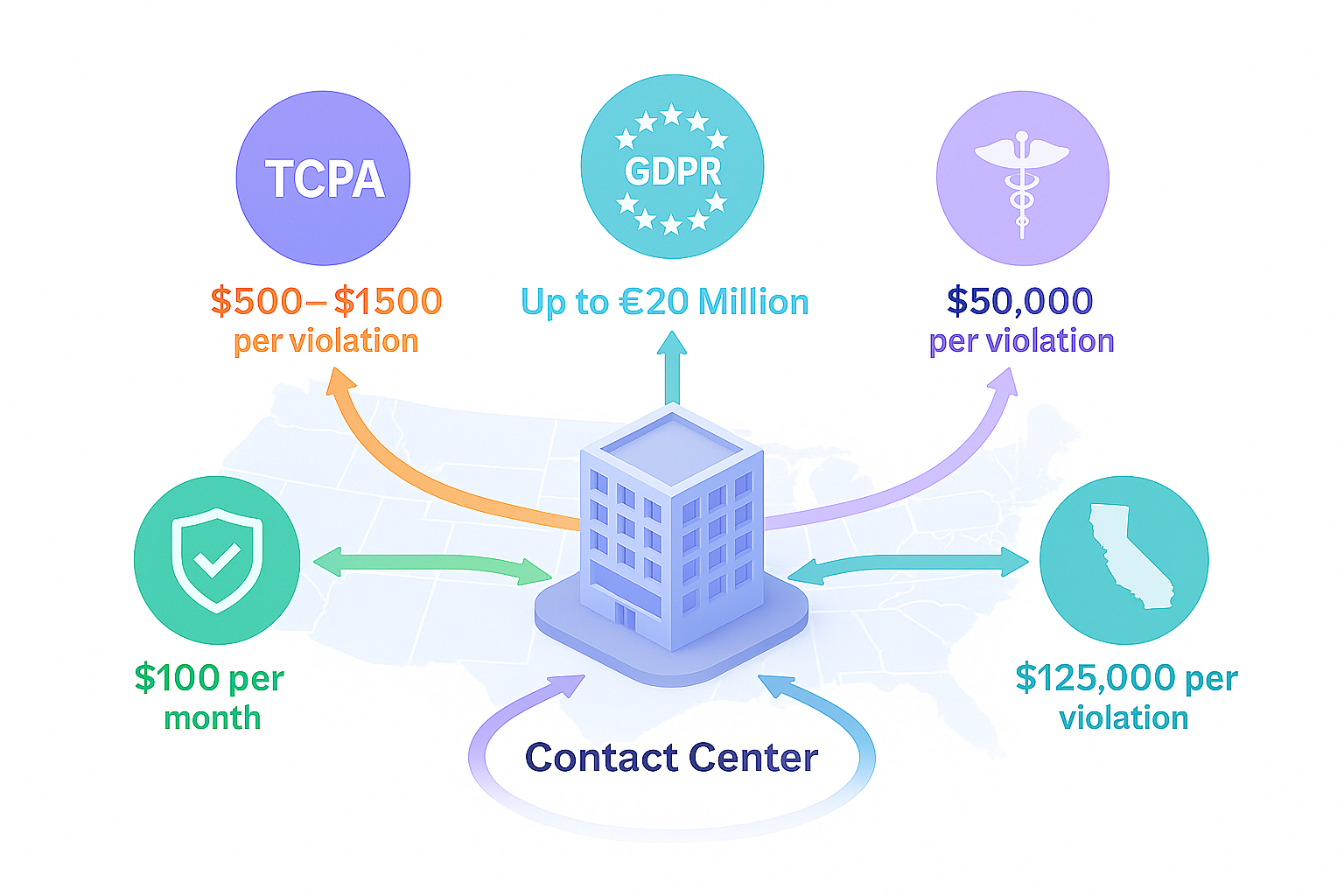

One accidental robocall can cost US$500 – 1,500 in TCPA damages before class action multipliers even enter the picture. Meanwhile, GDPR enforcers in Europe have issued single fines north of €400 million when recording or storing customer data without proper consent. Add card holder data rules (PCI DSS 4.0), protected health information (HIPAA) and fast moving state AI privacy bills, and the compliance landscape feels like a minefield.

This article is your navigational chart: no fluff, just the essentials a busy Ops or CX leader needs to steer clear of penalties while keeping service seamless.

The 2025 regulation landscape at a glance

| Jurisdiction | What it covers | Non-compliance risk | Quick tip |

|---|---|---|---|

| TCPA & TSR (US) | Prior express consent, DNC, call-time windows | $500–$1,500 per call; class actions | Use real-time DNC scrubbing & STIR/SHAKEN |

| GDPR / UK GDPR | Recording, storage & transfer of any PII from EU/UK residents | Up to 4 % of global turnover | Pause-recording for sensitive data |

| PCI DSS 4.0 | Card-holder data capture & storage | Card-scheme fines, payment-processor bans | Auto-redact PAN before storage |

| HIPAA | Voice PHI in healthcare interactions | $100–$50k per record + audits | Store recordings in encrypted HIPAA-ready vault |

| Emerging state AI laws | Consent for AI recording / analytics (e.g., WA HB 1671) | Civil penalties & AG actions | Declare AI usage at call start |

(No legal advice confirm with counsel.)

Quick start compliance checklist

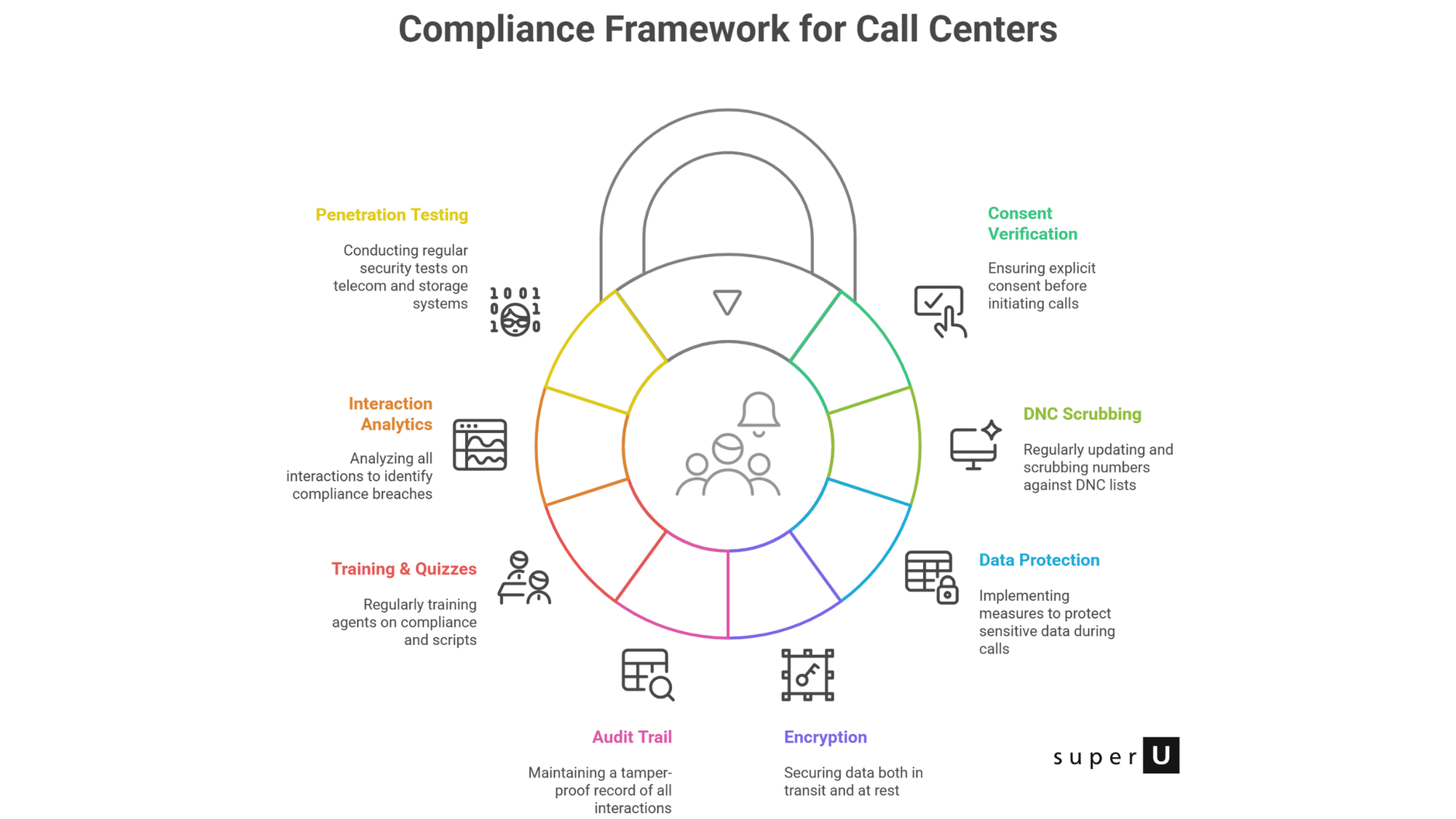

- Verify consent basis (opt-in, contractual, legitimate interest) before dialing.

- Scrub numbers against national & internal DNC every 24 h.

- Trigger auto-pause when agents request card or health data.

- Encrypt recordings in transit & at rest; restrict playback via RBAC.

- Keep a tamper-proof audit trail (metadata + hash) for 5-7 years.

- Schedule quarterly training & spot-quiz agents on key scripts.

- Run 100 % interaction analytics sampling misses 98 % of violations.

- Conduct twice-yearly penetration tests on telecom & storage stack.

Best practices by call type

Outbound sales

Before each dial, your system should re-check consent and DNC status in real time, then keep a running watch for risky phrases so reps can course-correct while the customer is still on the line. Keeping those safeguards live not only avoids TCPA mishaps but also gives agents confidence to focus on value rather than legal fine print.

Collections & debt recovery

Debt-collection calls must open with a clear “mini-Miranda” disclosure and respect federal and state caps on daily attempts; embedding those rules in your dialer logic ensures agents never overstep. Pair that with automatic call-disposition coding so you can defend every interaction if the CFPB or a state AG comes knocking.

Customer support / service

Support lines should announce recording up front and offer a no-record alternative; if a caller opts out, silent screen-note capture lets agents document the issue without audio storage. Once a ticket closes, delete or anonymise data under GDPR’s minimisation principle so your vault never holds more than it needs.

Building a compliance-first culture

Turning compliance into muscle memory starts with micro learning bursts: five-minute interactive lessons dropped into an agent’s day will stick far better than a yearly slide-deck marathon. Supervisors can reinforce the habit by celebrating “compliance wins” during QA reviews public praise for doing it right sparks peer-level accountability far faster than red-pen corrections alone.

Next, let AI analytics surface exemplary calls so teams hear what great compliance sounds like, not just read policy PDFs. When agents see colleagues showcased for nailing both empathy and legal language, they realise rules aren’t red tape they’re the runway for better conversations.

Tools & resource library

- FTC & FCC portals for latest TCPA rulings.

- CMS GDPR Enforcement Tracker learns from real-world fines.

- PCI Security Standards Council document hub for v4.0 clarifications.

- HIPAA Journal explainer on business-associate duties.

- State AI bill dashboards (NCSL) to monitor new consent requirements.

Bookmark these; check monthly.

Glossary

- DNC – Do Not Call registry; must scrub before dialing.

- PII/PHI – Personally / Protected Health Information.

- STIR/SHAKEN – Caller-ID authentication standard reducing spoofing.

- Redaction – Removal or masking of sensitive data in recordings or transcripts.

- Audit trail – Immutable log proving who accessed what, when.

FAQs

Q1. Where do I see the latest TCPA updates?

The FCC’s Consumer Help Center publishes notices and rate-adjusted fine amounts quarterly.

Q2. Do small 20-seat centers really need encryption?

Yes PCI and HIPAA apply based on data handled, not company size. Cloud-native tools make AES-256 affordable.

Q3. Is AI-based sentiment analysis allowed under GDPR?

It is, provided you state the lawful basis, inform callers and avoid automated decisions without human oversight.

Q4. How often should we retrain agents?

Quarterly micro-sessions with annual certification is the emerging norm among top performers.

Q5. Easiest way to validate my DNC list?

Subscribe to the FTC SAN database or use an API-based scrubber that updates nightly.

Next step

Compliance isn’t a destination it’s a moving target. The smartest teams automate the heavy lifting so humans can focus on empathy.

SuperU’s AI voice agent comes with built-in TCPA, GDPR and HIPAA guard-rails, real-time transcript redaction and immutable audit logs.

Ready to de-risk every conversation? Chat with a SuperU Founder today.

Start for Free – Create Your First Voice Agent in Minutes