The urgency: why “good enough” call recording is officially broken

Reps now juggle voice, video, chat, and email in the same selling motion. Manual note-taking can’t capture that complexity, which is why teams using AI-driven call guidance close 35 % more deals than peers who rely on subjective coaching. Gartner adds fuel to the fire: 40 % of enterprise apps will embed conversational AI by 2024 up from just 5 % in 2020. If you postpone the upgrade, you’re handing a competitive edge to the early adopters.

Conversation intelligence, defined

Think of it as a three-layer cake:

- Capture – real-time transcription of every spoken and written word.

- Comprehend – natural-language models tag sentiment, intent, objections, and even competitors.

- Coach – the system feeds instant cues to reps and delivers bite-sized lessons to managers.

Unlike legacy call recording, CI platforms surface why a deal moves, not just what was said.

Non negotiable capabilities for 2025 buyers

Ask each vendor to run a live discovery call with your team and prove cue accuracy in real conditions, not a canned demo.

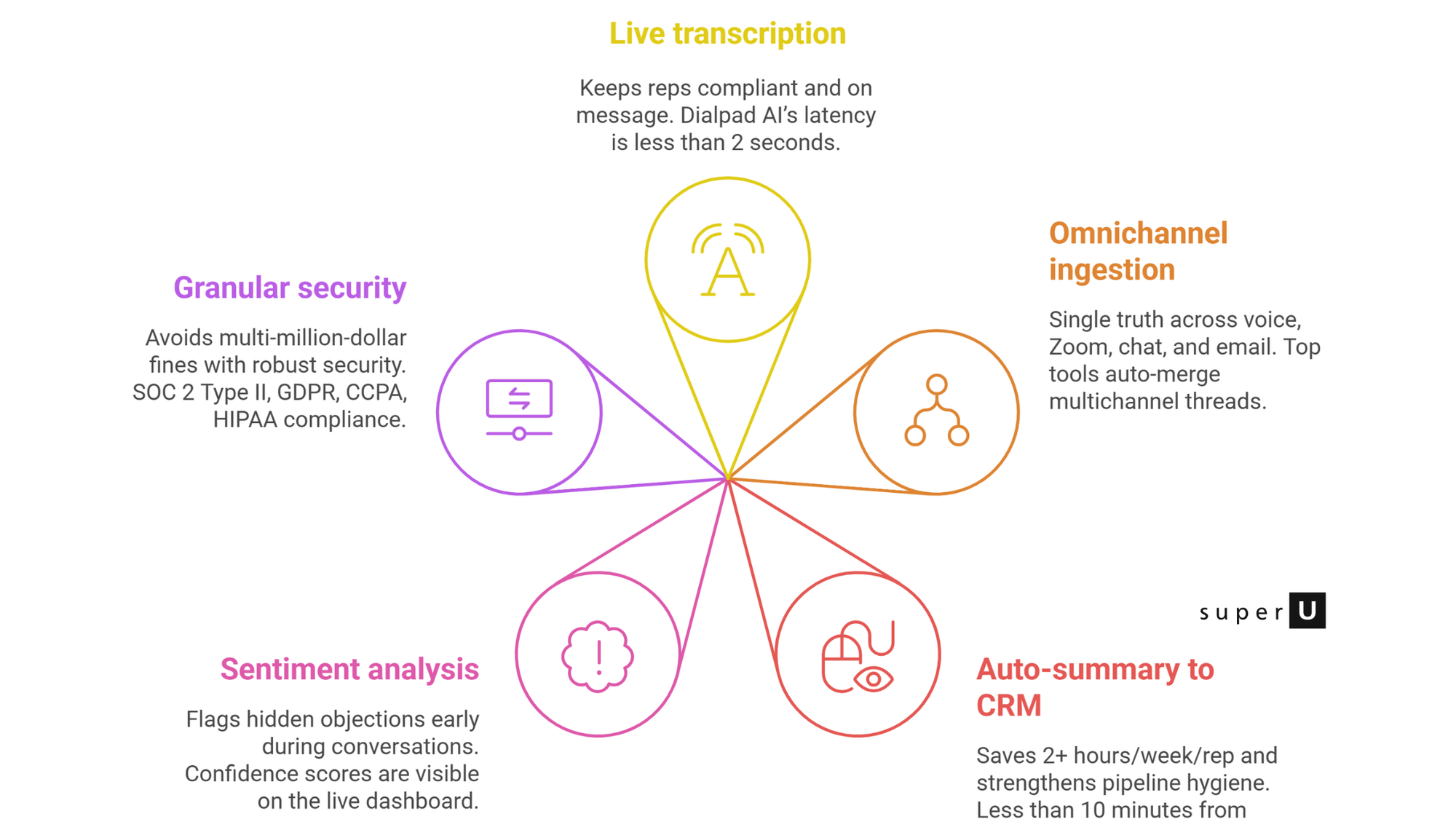

Digging deeper: five AI features that separate leaders from laggards

1. Real-time transcription that learns

Platforms like Dialpad continuously retrain language models on industry jargon, so accuracy climbs instead of plateauing. Look for custom vocabulary uploads and automatic dialect detection.

2. Dynamic talk-track guidance

Instead of static scripts, cutting-edge CI tools push objection-handling cards when specific phrases appear. One rev-ops team shaved 18 seconds off average handle time simply by highlighting next-best questions at the right moment (internal benchmark shared by the author).

3. Post-call action mining

Auto-generated to-dos, risk alerts, and follow-up email drafts cut admin, letting reps focus on selling.

4. Deal-risk heat maps

Color-coded views of “stuck” deals combine sentiment, next-step gaps, and competitive mentions perfect for stand-ups.

5. Closed-loop coaching analytics

Managers receive playlists of top calls plus scorecards that track rep improvement over time.

Quantifying the upside (show me the money)

| KPI | Industry baseline | Post-CI benchmark |

|---|---|---|

| Win rate | 24 % | 31–38 % |

| Rep ramp-time | 6–12 months | “Few weeks” at Plate IQ after Gong rollout |

| Customer-satisfaction (CSAT) | 78 % | 85–90 % when real-time sentiment drives instant save offers (CX Today) |

| Average handle time | 6:00 | 5:00 or lower with cue cards (author study) |

| Compliance incidents | 5/qtr | ≤ 1/qtr using proactive redaction |

Plug your own target deltas into the chart and you’ll have a board-ready business case within an afternoon.

Pricing models, decoded

| Model | Who should choose it | Watch-outs |

|---|---|---|

| Per-seat ($90–$140/user/mo) | Inside-sales orgs with stable headcount | Seasonal hiring sends costs soaring |

| Usage-based ($0.03–$0.10/min) | Support centres with fluctuating call loads | Video minutes often billed 2× voice |

| Hybrid licence | Enterprises needing budget predictability | Requires tight forecasting & quarterly true-ups |

Most companies land somewhere between $50 and $150 per rep each month for full voice+video coverage. Always model three-year TCO, including storage fees.

The 30-day rollout blueprint

Week 1 – Connect & baseline

- Sync dialer, Zoom, chat, and email.

- Import 60 days of closed-won/lost data for ground truth.

Week 2 – Pilot coaching pod

- Five high-energy reps + two frontline managers.

- Track talk-to-listen ratio, next-step adherence, and objection-handling tally.

Week 3 – Automate workflows

- Push summaries + tasks into CRM.

- Launch daily “golden call” playlist in Slack.

Week 4 – Expand & optimise

- Roll to next cohort; refine keyword libraries.

- Stand up compliance dashboard; start quarterly score-carding.

Teams that follow this cadence typically recover the licence cost by Day 35, thanks to faster deal cycles and reduced ramp.

Integration stack & data-quality best practices

1. CRM first – bidirectional sync; avoid CSV exports that break IDs.

2. Dialer & VoIP – real-time webhook or SIP recapture to prevent recording gaps.

3. BI layer – pipe transcripts into Snowflake or BigQuery for deeper modeling.

4. Single sign-on – SAML or OIDC to enforce role-based access without duplicate passwords.

Data garbage in means garbage insights out so invest a few hours in ID hygiene before ingestion.

Beyond analytics: automating QA & coaching loops

Top CI platforms score 100 % of calls something human QA teams could never afford. Managers then spend their time on high-leverage coaching instead of random sampling. Predictable Revenue found this approach raises quota-attainment by 13 % YoY.

Vendor shortlist: where each shines

| Vendor | Edge | Possible gap |

|---|---|---|

| Clari Copilot | Deep revenue dashboards & pipeline AI | Support workflows less mature |

| Zendesk AI | Built for service; natively triggers macros | Sales features still evolving |

| Qualtrics Experience iQ | VoC expertise & emotion detection | Higher starting price tier |

| Rising challengers (CallMiner, Insight7) | Industry-specific NLP packages | Smaller partner ecosystem |

Pick based on outcome fit, not sheer feature count.

DIY ROI math

Assumptions • 20 reps, $100/user/mo licence → $24 000/year • 500 deals/quarter at 24 % win rate → 120 wins • Each win = $8 000 ARR

If CI lifts win rate by conservative 6 pp (to 30 %), you close 30 extra deals = $240 000 ARR. That’s a 10× licence payback in the very first year.

Wrap up

Conversation intelligence is no longer a “nice to have.” It’s the connective tissue between the customer’s voice and your revenue engine. If you want insights to speak back not just sit in dashboards SuperU Voice Agent closes the loop. Our AI listens, learns, and responds in real time, then feeds those golden nuggets straight into your CRM and enablement tools.

Book a 15-minute strategy call and watch it turn your next conversation into measurable revenue.

FAQs

1. Does it cover both phone and Zoom?

Yes. Leading platforms ingest PSTN, VoIP, and video, normalising transcripts for unified dashboards.

2. Which CRMs integrate natively?

Salesforce, HubSpot, Microsoft Dynamics, plus REST or GraphQL endpoints for custom stacks.

3. Is multilingual sentiment supported?

English, Spanish, French, German by default; enterprise tiers reach 30 + languages with custom glossaries.

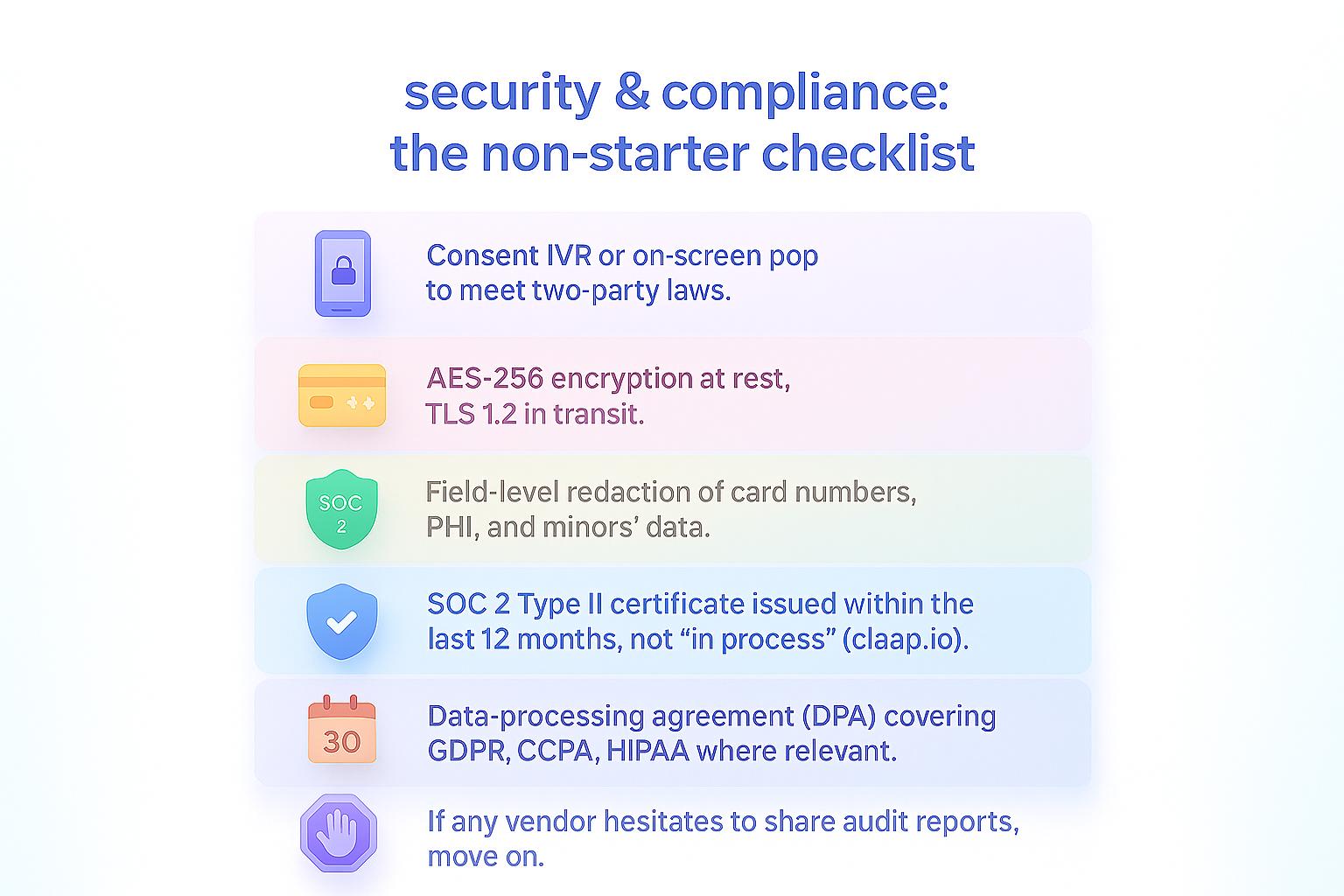

4. How is sensitive data protected?

Field-level redaction, strong encryption, and annual SOC 2 audits satisfy PCI, HIPAA, and GDPR mandates.

Start for Free – Create Your First Voice Agent in Minutes