A financial answering service keeps your lending desk open 24/7, routes calls to live or AI receptionists trained in finance regulations, and when you choose SuperU converts after hours inquiries into signed loan documents without adding head count.

The Hidden Cost of a Missed Call in Lending

Internal call tracking studies show that a mortgage prospect who lands on voicemail dials three competitors within 15 minutes. The average lost commission per unanswered lead tops $4 200. Twelve missed calls a month can leak half a million dollars a year before you count downstream referrals.

SuperU in Pole Position

- Lightning response: AI voice agents answer in under one ring.

- Smart intake: The bot captures borrower details, auto pulls credit checkpoints, and tags intent.

- Seamless hand off: Edge case questions route to standby human agents.

- Plug and play integrations: Encompass, HubSpot, Salesforce, and 15+ others.

- Transparent pricing: Usage based at $0.05 per minute, with volume discounts. SuperU sits first on every comparison matrix below for speed, compliance depth, and total cost of ownership.

Compliance and Security Are Non Negotiable

Financial answering partners must tick these boxes:

| Requirement | Why It Matters | How Top Providers Handle It |

|---|---|---|

| PCI DSS | Secure handling of card data, application fees | SuperU encrypts recordings and redacts card numbers automatically |

| GLBA | Protects personally identifiable information | All staff sign GLBA confidentiality; AI models strip PII from transcripts |

| Call Recording Ownership | Needed for audits and disputes | SuperU and MAP give lenders full, searchable archives |

| Redundancy & Disaster Recovery | Keeps lines live during outages | MAP runs dual U.S. data centers; SuperU auto fails to cloud region B |

Feature Checklist That Separates Helpers From Headaches

1. 24/7 or overflow scheduling

2. Bilingual or multilingual reps

3. Dynamic, product specific scripts you can edit yourself

4. Real time analytics dashboard (answer rate, hold time, loan pipeline impact)

5. CRM and LOS integrations out of the box

6. Instant call recordings with keyword search

Cost Scenarios From Solo Broker to National Lender

| Lender Type | Monthly Minutes | SuperU AI Cost | Traditional Live Agents | In House Staff |

|---|---|---|---|---|

| Solo broker | 300 | $15 | $225 – $450 | $2,800+ salary |

| Regional credit union | 1800 | $90 | $1,300+ | $8,300+ salaries & benefits |

| National non bank lender (peak) | 15,000 | $600 | $8000+ | $40,000+ fully loaded |

Traditional live agent pricing (e.g., Goodcall, Posh) ranges $0.75–$1.50 per minute. SuperU’s AI first model cuts those costs by 85 % without sacrificing compliance.

One Afternoon Implementation Roadmap

1. Forward or port your number. Takes 10 minutes with your carrier.

2. Define call flows. Sales, servicing, collections, each with its own script.

3. Add compliance prompts. “This call may be recorded under GLBA.”

4. Connect integrations. Paste API keys; sync takes seconds.

5. Run five test calls. Listen, tweak, and go live.

Total time investment: ~2 hours.

Success Metrics Lenders Actually Track

- First call answer rate (goal: 95 %+)

- Average handle time vs. in house baseline

- Borrower satisfaction / NPS

- Funded loan conversion per 100 inbound calls

- Compliance audit pass rate (zero red flags)

Provider Scorecard SuperU vs. Goodcall, MAP, Posh

| Provider | Answer Speed | Compliance Strength | Integrations | Starting Price | Stand Out Feature |

|---|---|---|---|---|---|

| SuperU | Sub 1 ring (AI) | PCI DSS, GLBA, AI redaction | Encompass, Salesforce, 15+ | $0.05/min | AI + live fail over |

| Goodcall | 24/7 live agents | Secure message handling | Major CRMs | $0.75/min | Mortgage specific scripts |

| MAP | Live agents 24/7 | HITRUST, redundant data centers | Custom API hooks | Quote | U.S. only staffing |

| Posh | App driven live answer | Script customization | Posh mobile app | Plan tiers | Instant status toggle |

Voices From Reddit

Thread highlights from r/MortgageBrokers, r/CommercialRealEstate, and r/Fintech:

- u/RateLockHero: “Switched to AI answering after hours; funded an extra $1.1 M last quarter. Clients think it’s a real person.”

- u/CreditUnionOps: “Members hang up after 30 sec. Our first ring pickup jumped to 97 % with a hybrid AI + human setup.”

- u/HardMoneyHustle: “Biggest win: no more phone trees. Live fallback saved three deals in one week.”

- u/Alt DocDan: “GLBA compliance was the deal breaker. Only a handful of services actually knew what that meant.”

These candid takes show lenders prize speed, authenticity, and transparent billing and they punish vendors that hide fees or skimp on compliance.

Red Flag Checklist to Avoid Buyer’s Remorse

- Hidden “whisper” or after hours surcharges

- No ownership of call recordings

- Offshore data storage without U.S./EU protection

- Long term contracts with heavy cancellation fees

- No contingency plan for carrier outages

Spot any two of these? Keep shopping.

Frequently Asked Questions

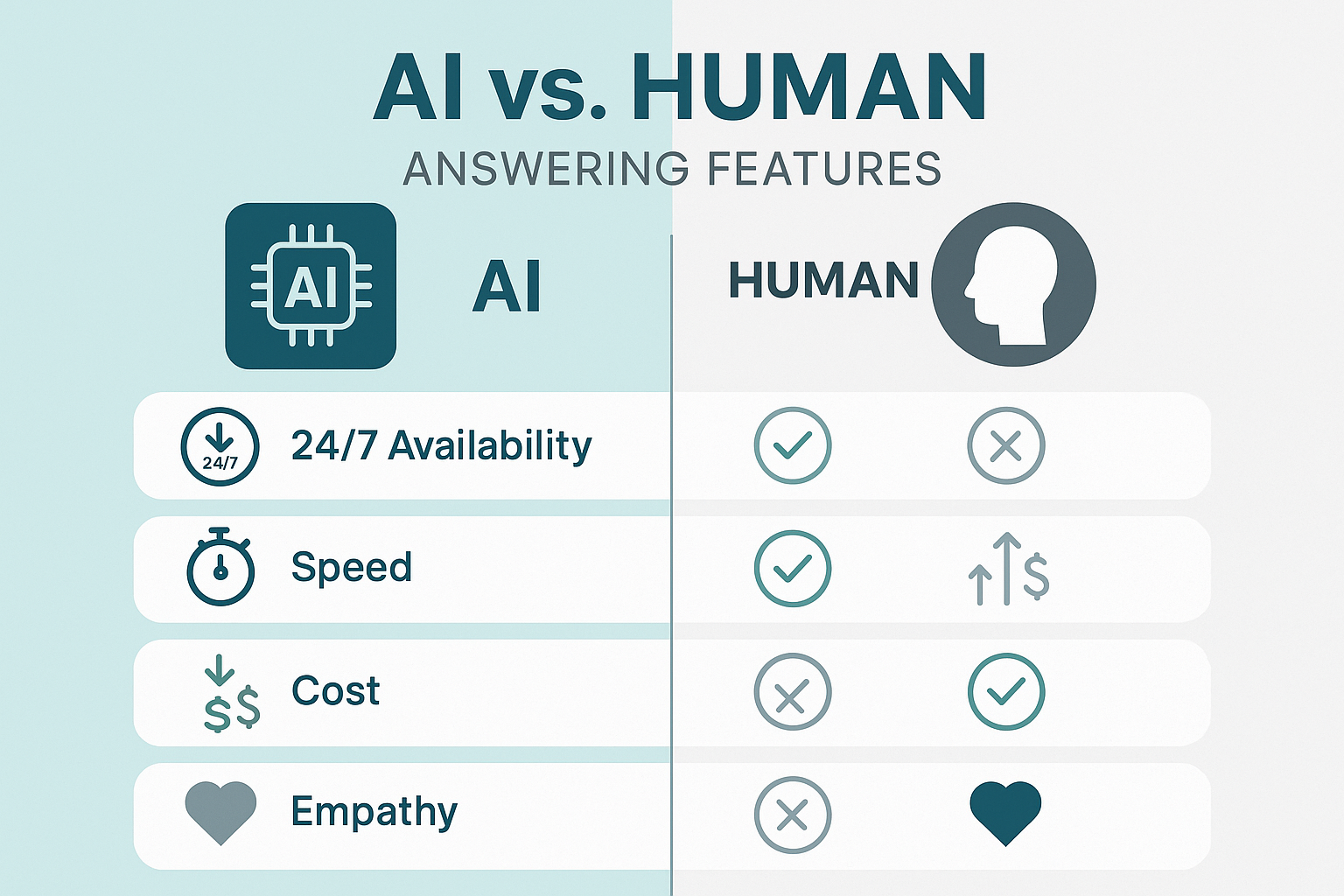

1. Can I blend AI and live agents?

Yes. Use AI for routine questions and switch to humans for complex scenarios.

2. How fast can we scale during rate lock surges?

SuperU’s autoscaling handles minute to minute spikes automatically.

3. Will transcripts land in my CRM?

Every call pushes instantly to your chosen record, tagged by intent.

4. Do you support bilingual callers?

SuperU covers English and Spanish out of the box; Goodcall and MAP offer bilingual live reps.

5. Is there an SLA on pickup time?

SuperU guarantees sub 2 ring AI answer. MAP specifies a live answer within four rings.

Conclusion

Every missed call leaks margin. A purpose built financial answering service, especially an AI first platform like SuperU, keeps lines open, stays audit ready, and pays for itself in weeks.

Start a two week trial, connect your CRM, and watch “Sorry we missed you” disappear from your voicemail.

Start for Free – Create Your First Voice Agent in Minutes