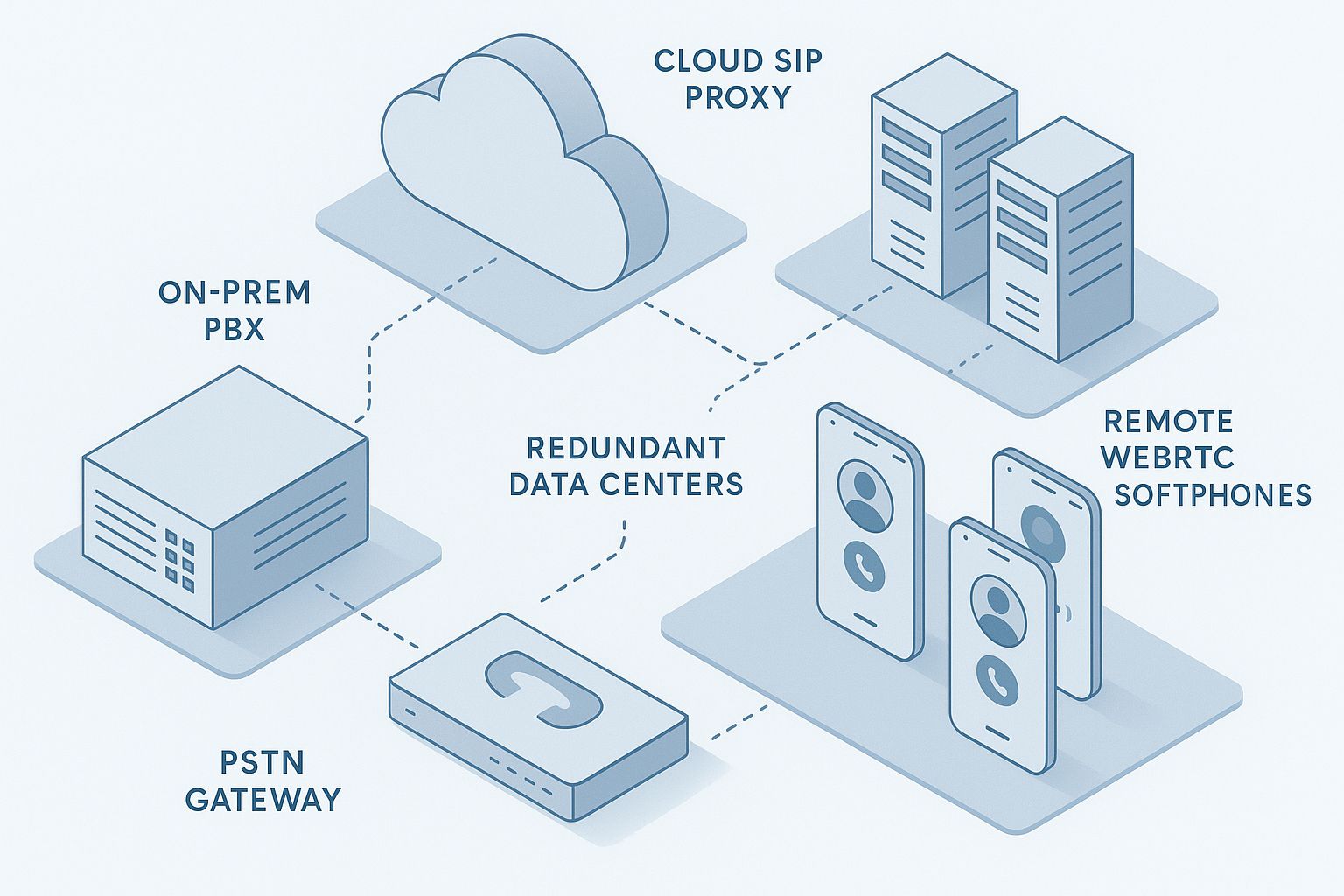

A SIP voice service replaces legacy phone circuits with an internet-based connection that uses the Session Initiation Protocol (SIP) to set up, manage, and tear down each call, carrying your voice as secure IP traffic rather than over copper lines.

Why businesses are finally making the leap

Switching to SIP trunks is no longer just a tech upgrade; it is a finance, operations, and resilience decision rolled into one.

- Cost relief that matters. Typical adopters report 30–60 percent savings by dropping PRI line rentals and paying only for the call paths they actually need.

- You can resize this afternoon. A carrier can spin up extra channels within minutes, no truck roll, no new copper because all routing lives in software.

- Built-in business continuity. Geo-redundant points of presence reroute sessions automatically if a fiber cut or data-center issue strikes, keeping sales and support lines open.

SIP trunk vs VoIP PBX in plain English

“VoIP” simply means any voice that rides over an IP network. A SIP trunk is the virtual pipeline that connects an existing PBX to that IP world. With trunks, you keep your current dial plan, phones, and call-recording stack, but shed the physical circuits. In other words, VoIP is the genre; SIP trunks are the distribution channel.

Pricing models you will see in real quotes

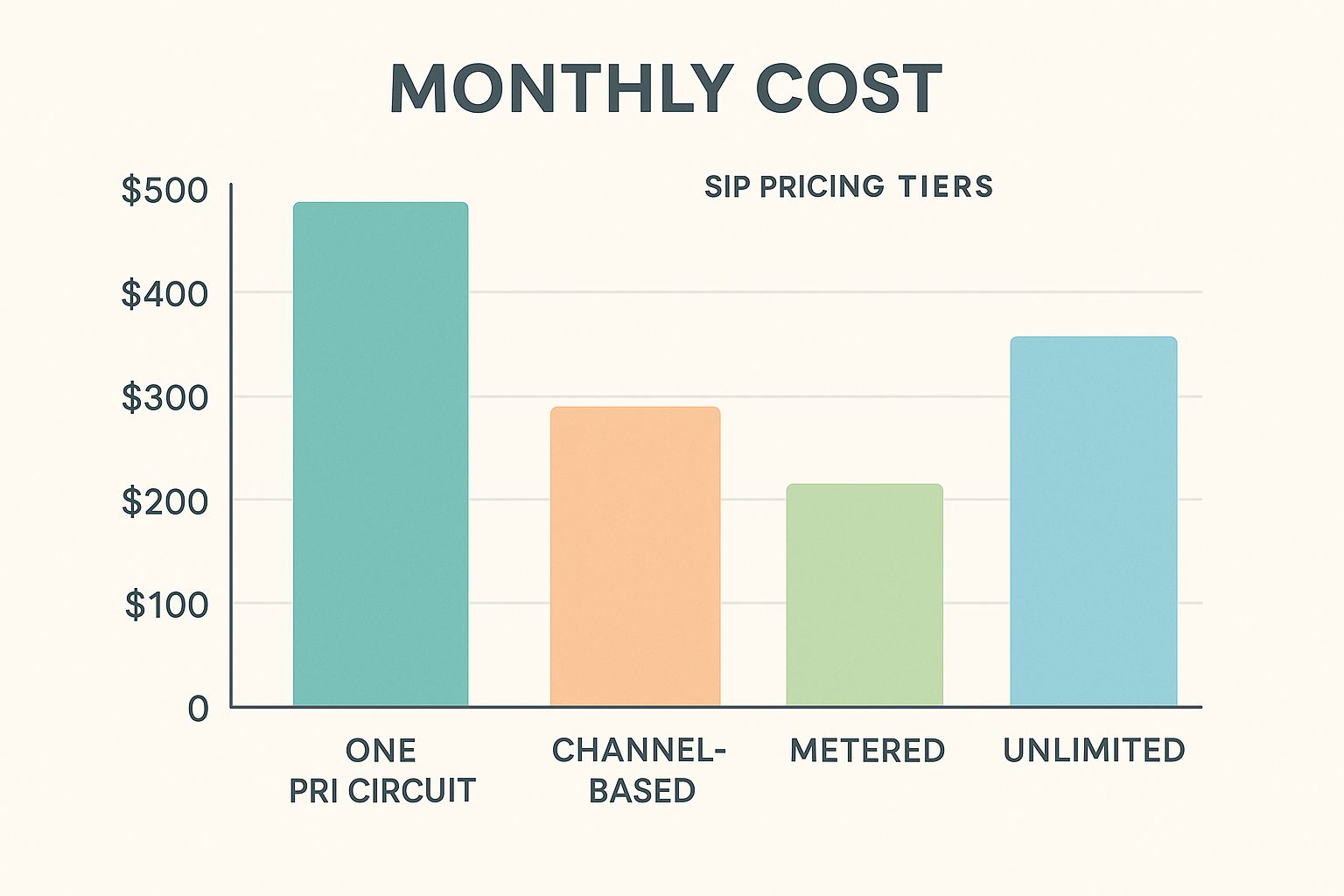

| Model | Billing logic | Best fit |

|---|---|---|

| Channel-based | Flat monthly price per concurrent call path | Predictable voice loads |

| Metered | Low trunk fee plus per-minute usage | Seasonal or event-driven peaks |

| Unlimited | Higher flat fee, no minute charges | High-talk-time contact centers |

A single legacy PRI (23 channels) often tops $500 USD/month; an equivalent SIP package can start at ≈ $175 with room to flex up or down at will.

How to evaluate a SIP service provider, no regrets later

1. Uptime pledge. Look for documented 99.999 % SLA and a public map of redundant points of presence.

2. Security stack. Mandatory TLS/SRTP, real-time fraud monitoring, and STIR/SHAKEN call signing to stop spoofing.

3. Number inventory. Do they offer local DIDs in every state or country you operate in? Confirm before paperwork.

4. Support depth. Ask if front-line engineers troubleshoot SIP traces or simply read knowledge-base scripts.

5. Transparent pilot window. A credible carrier issues test credentials, lets you hammer the trunks, and shows jitter/packet-loss dashboards.

Migration roadmap: from discovery to “dial tone cut-over”

Step 1 – Assessment: Run a week-long packet capture to benchmark jitter, latency, and mean-opinion-score (MOS) across WAN links, then size trunks using your peak concurrent calls plus 20 % headroom.

Step 2 – Pilot: Stand up a parallel SIP trunk, route 5 % of outbound calls, and watch post-dial delay plus call-quality graphs for seven business days.

Step 3 – Porting Stage: number ports in weekly chunks; always publish a temporary fallback DID until each batch is confirmed live.

Step 4 – Cut-over weekend: Flip routing for every DID, run real-time call-quality dashboards, and keep PRI gear powered for 24 hours in case rollback is required.

Step 5 – Optimize Tune codec choices (G.711 for fidelity, G.729 for bandwidth), enable silence suppression, and pipe CDRs into BI dashboards so finance sees hard savings.

Network & security checklist before you sign the order

- Bandwidth math. Allow roughly 100 kbps per G.711 voice stream in each direction; double the total for comfort.

- Quality-of-Service tags. Mark SIP and RTP on every router so voice outranks Netflix traffic.

- Edge protection. Deploy a session border controller (physical or virtual) to inspect SIP packets, block bad actors, and encrypt media.

- Regulatory guardrails. If you store cardholder data or health records, ask for PCI-DSS or HIPAA attestation letters.

- SIP-I support (rare). Needed only when you interconnect with SS7/ISUP gateways mostly a carrier-grade requirement.

Mobile and remote-work angles

Ever Googled “what is SIP calling in Android”? Modern softphone apps register directly to your trunks, presenting a single corporate caller-ID wherever staff roam. Choose clients that support push notifications so backgrounded apps still ring, and test Wi-Fi-to-LTE handoff to avoid mid-call drops.

Conclusion

A well-planned SIP voice service can chop network spend, unlock on-demand scale, and hand your business a continuity plan your legacy telco could never match. Map bandwidth, vet providers rigorously, pilot before porting and you will flip the switch confident that every call will land cleanly.

Need a shortcut? Ask a SuperU voice agent for a five-minute savings simulation. We will load your real call data, model the three pricing options, and email a break-even chart you can walk straight into finance.

Frequently asked questions

1. How does the SIP protocol actually place a call?

Your handset sends an INVITE to the proxy, which locates the destination endpoint, negotiates codecs, and exchanges Session Description Protocol (SDP). Once both sides agree, audio flows via RTP until a BYE ends the session.

2. How many trunks do I need per hundred agents?

A safe rule is 4:1 during peaks 25 channels for 100 busy seats. Analytics-heavy centers sometimes push 6:1 by using overflow routing to the cloud.

3. Can I keep existing toll-free numbers?

Yes, but toll-free ports often take two to three weeks. File LOAs early and budget overlap service so callers never hit dead air.

4. What should I demand in an SLA?

Five-nines availability, <1 % packet loss, <80 ms one-way latency inside the provider network, and a commit to resolve critical faults within one hour.

5. Is SIP the same as VoIP?

All SIP trunks are VoIP, but not all VoIP runs on SIP. Some vendors use proprietary protocols; SIP’s open standard makes multi-vendor interop easier.

Start for Free – Create Your First Voice Agent in Minutes