About ZetApp

ZET is a credit building app for India. The team helps new credit users to start safely with an FD backed Magnet Card issued with SBM Bank India and then grow into a regular credit journey. They reach users across Tier-2, Tier-3, and Tier-4 markets, teach the basics of credit, and aim to move people toward a 750+ score.

The growth team knew outbound mattered. But manual dialing slowed them down. Agents spent hours calling lists, explaining FD backed cards, and answering the same questions about UPI on RuPay credit. By the time someone picked up, the day was half gone. Hiring more callers didn’t feel like a real fix.

Why more headcount wasn’t the answer

ZET grew out of OneCode, which built a huge distribution network in Bharat. They understand scale. They also know onboarding new callers takes time, training, and budget. They wanted more real conversations this week, not a long hiring cycle. They needed a way to explain Magnet Card, UPI on credit, and score building at volume, in the right language, without losing quality.

How SuperU entered

That’s where SuperU stepped in. We set one goal with the team: create more qualified conversations and more activations without changing ZET’s core process. Keep the education tone. Keep compliance front and center. Keep data flowing into the tools the team already uses.

Setting the stage

We started with the audience ZET cares about most. The team shared their target lists, regions, and language mix. We connected SuperU to their CRM and calendars so every call outcome showed up where the team works. We ran dry calls to internal numbers and a few friendly users. We tuned pacing, accents, and the way the AI explains an FD backed card and UPI on credit. We set calling windows that matched local hours so users didn’t get pinged at odd times.

Going live

On day three, we went live. Calls went out back to back. No dead air. When someone answered, the voice sounded human and calm. It opened simply, asked two or three clean questions, and listened. If a user leaned in, SuperU booked a slot for an app walkthrough or pushed a KYC link. If the person wasn’t a fit, the AI tagged it and moved on. Every outcome landed in the CRM with notes. The team didn’t need to guess what happened.

The first week that changed the pace

By the end of the first week, SuperU made ten thousand calls. That number felt unreal inside ZET because the old process could not get there in weeks. The count mattered, but the content mattered more. Those calls turned into real talks about credit basics, Magnet Card activations backed by an FD, and first UPI on credit transactions. On Monday, reps opened their dashboards and saw warm threads waiting: booked sessions, clean summaries, and clear next steps.

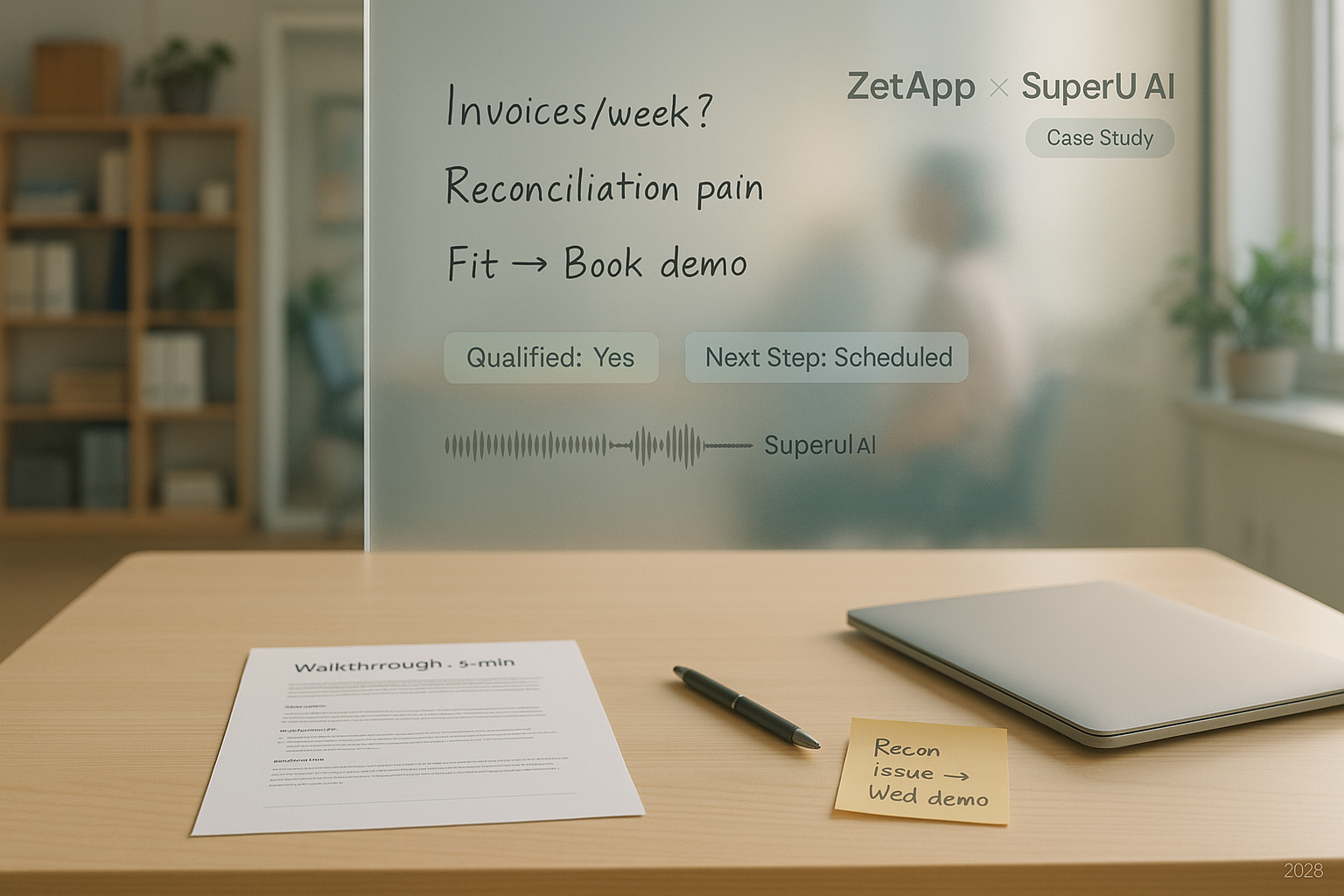

What a good call sounded like

Here is a simple example. The AI opened with a line about building a 750+ score with a safe start. The user said they never had a card. The AI asked how they pay today and where payments get stuck at month end. The user mentioned rent and bill timing. The AI explained how an FD backed Magnet Card builds history and how RuPay credit on UPI works in the places they already pay. It offered a five minute app walkthrough. The user said yes. The AI booked a slot for Wednesday with ZET’s advisor and dropped the key points into the calendar event. When the advisor joined, they already knew the user’s pain, monthly flow, and goal.

What changed for the growth team

Agents stopped living in the dialer and started living in real user journeys. Managers noticed it in coaching. Instead of pushing for more attempts, they coached how to turn a booked session into an activation and a first transaction. The pipeline looked cleaner because every stage had context.

Revenue in week one

Revenue showed up in week one. Funded FDs created Magnet Cards. Activations led to first spends on RuPay credit via UPI. Some users moved fast because the fit was obvious. Others moved forward with clear nudges in the app. The team saw it in their numbers and in their day. They had time to do the human work: build trust, answer edge cases, and guide people toward healthier credit habits.

Plugged into ZET’s stack

We did not ask ZET to rewire anything. SuperU plugged into the CRM they already used. Calls created contacts when needed. Activities logged with clean dispositions. Bookings followed the same routing rules. Short summaries posted to Slack so product, risk, and growth could see movement without hunting across tools.

Guardrails and language that build trust

Consent checks stayed on. Do not call lists stayed respected. Opt outs stuck across campaigns. We kept retries gentle and human. We supported Hindi, English, and common regional mixes like Hinglish so calls sounded familiar, not foreign. Each day we read transcripts, tightened a line, and pushed an update. Small changes stacked up. Openers got clearer. Objections got lighter. Bookings got smoother.

The Head of Growth at ZET put it simply:

“We couldn’t believe the scale. In the first week, SuperU made 10,000 calls, generated revenue, and freed our reps to actually sell. It’s like adding an army of SDRs overnight without the cost.”

Why it worked

ZET did not try to hire their way to more conversations. They scaled them. The voice felt natural, so people stayed on the line. Education happened fast, so users understood FD backed starts and UPI on credit. Handoffs were clean, so sessions started warm. And data flowed into the systems the team already trusted, so nothing got lost.

What ZET is doing next

The team is now rolling SuperU into renewals and upsells inside the app. That means reminders to top up FDs, timely limit increases, and offers linked to healthy score moves. They are also adding customer success outreach for health checks and feedback. The goal is the same as day one. Build a revenue engine that runs every day and keeps users on a good credit path.

Conclusion

If you run growth, you know the trade off. More calls or more callers. ZET chose a third path. More conversations with the same team. That choice paid off in seven days.

See how this works end to end